New Sony Cyber-shot Dsc-w810 20.1mp 6x Optical Zoom Digital Camera + Starter Kit, 1 - Pay Less Super Markets

Refurbished: Sony Cyber-shot DSC-W800 Digital Camera (Black) - with Memory Card Point & Shoot Cameras - Newegg.com

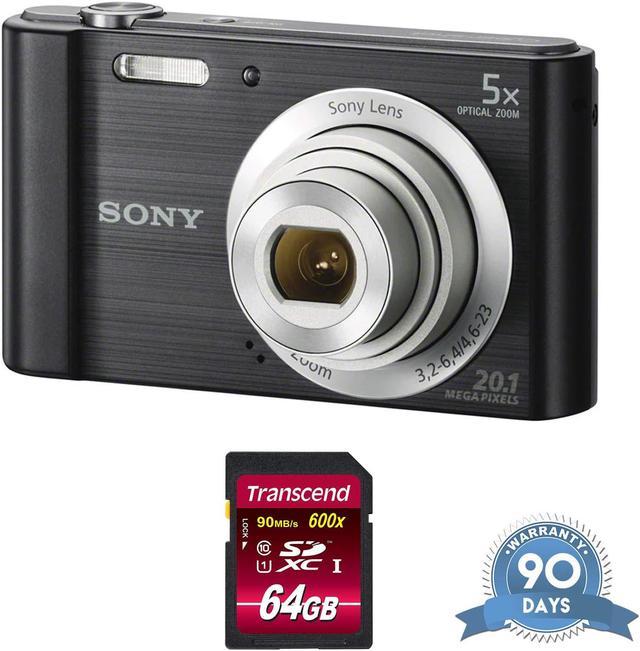

Sony Cyber-Shot DSC-W800 20.1MP Digital Camera 5x Optical Zoom Black with Accessory Kit - Walmart.com

Sony Cyber-shot DSC-W800 Digital Camera (Black) with Sandisk 128GB Essential Package | NJ Accessory/Buy Direct & Save

SONY Cyber-shot W800 Black 20.1 MP 5X Optical Zoom Digital Camera Point & Shoot Cameras - Newegg.com