Best Payment Gateways 2024: Top Secure Solutions Reviewed

A payment gateway handles the authorization and processing of payments between the merchant and the financial institutions. It ensures secure, efficient transactions, integrating directly with systems to facilitate online or in-person sales.

Selecting a payment gateway is critical to ensuring seamless and secure payment processing. For developers and tech-savvy businesses, this means looking for one that aligns with your technical requirements, offers strong API capabilities, and provides robust security measures to protect against fraud.

Top payment gateways comparison

The right payment gateway depends on your business needs. For this list, I looked at gateways that are known for their flexibility and customization options and I evaluated each one based on their pricing, security features, payment features, and support.

| Our rating (out of 5) | Monthly fee | Pricing structure | Customer support | Uptime (past 90 days as of writing) | Application process | |

|---|---|---|---|---|---|---|

| Stripe | 4.59 | $0 | Flat-rate, interchange upon request | 24/7 phone, email, chat support | 99.99% | Instant |

| Braintree | 4.49 | $0 | Flat-rate, interchange upon request | 24/7 emergency support | 99.99% | Instant unless additional docs are needed |

| Ayden | 4.43 | $0 | Varies | Via support ticket | 100.00% | Manual approval |

| 2Checkout (now Verifone) | 4.39 | $0 | Flat-rate | 24/7 merchant support | 99.98% | Manual approval |

| Authorize.net | 4.36 | $25 | Flat-rate | 24/7 phone and chat support | 99.99% | Manual approval |

Stripe: Best overall

Our rating: 4.59 out of 5

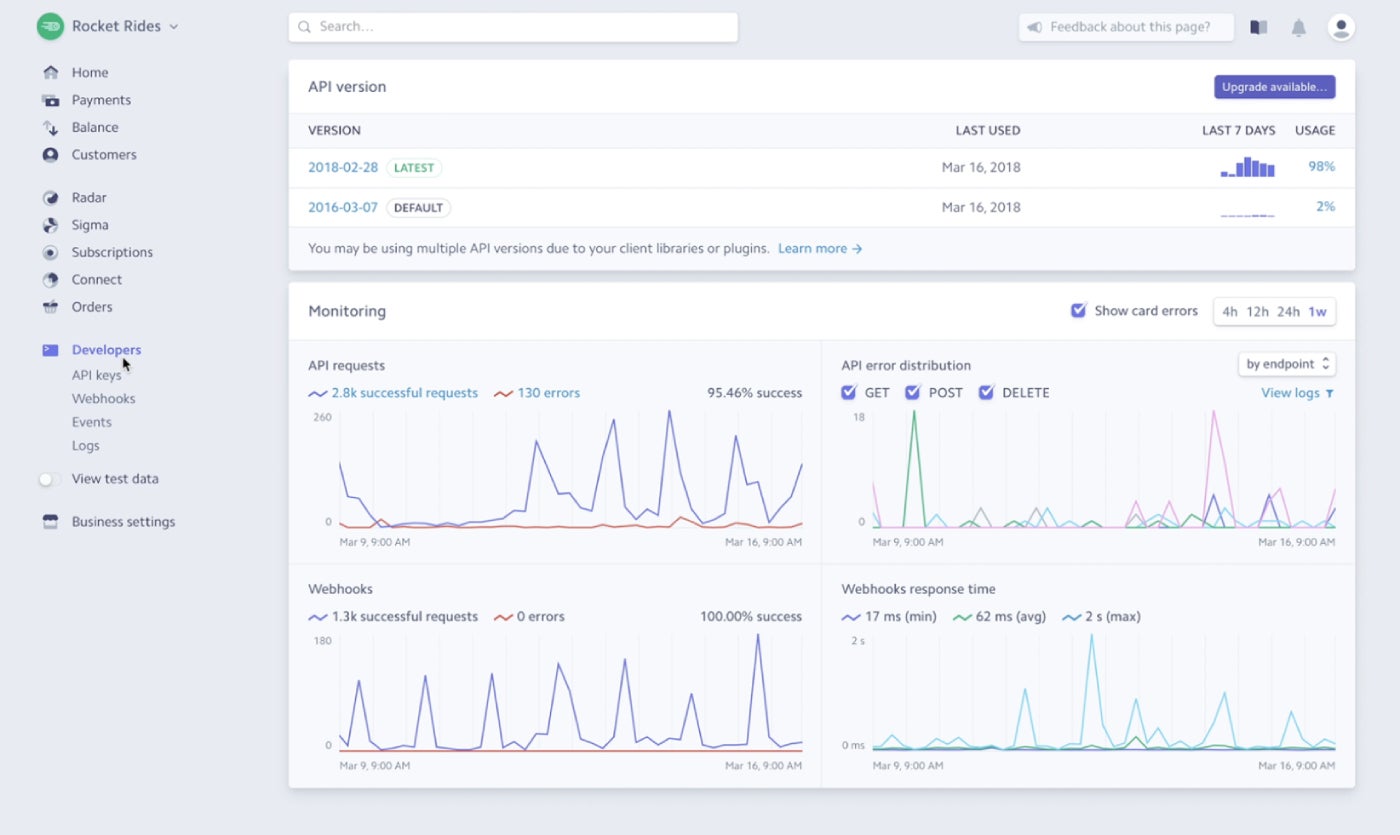

Stripe stands out as the best payment gateway for developers and tech-savvy businesses because of its powerful API, extensive developer tools, and customizable payment solutions. It excels in handling complex payment flows, global payment support, and seamless integrations, which allow users to create tailored checkout experiences. Stripe also offers zero monthly fees, instant approval, and 24/7 support, making it a cost-effective and accessible solution for businesses of all sizes.

Why I chose Stripe

When it comes to API flexibility, SDK availability, and customizability, Stripe is top of mind among tech-savvy businesses and developers. It holds up well to its developer-friendly reputation — it offers the most robust and well-documented APIs, SDKs in any language, and very active developer communities. Less tech-savvy businesses will still find value in using Stripe as its payment gateway because of its numerous easy third-party integrations that require less coding than full customizations. It is also one of the very few payment gateways that allow businesses to immediately start accepting payments without any upfront cost or lengthy approval times.

Pricing

- Monthly fee: $0

- Payment processing fees:

- In-person transactions: 2.7% + 5 cents per transaction.

- Online transactions: 2.9% + 30 cents per transaction.

- Keyed-in transactions: 3.4% + 30 cents per transaction.

- ACH payments: 0.8%, capped at $5 per transaction.

- Add-on fees:

- Invoicing: 0.4% per paid invoice.

- Recurring billing/subscription: 0.7% of billing volume.

- Cross-border fee: 1.5% per transaction.

- Currency conversion: 1% per transaction.

- Custom pricing available for high-volume businesses.

Features

- Powerful API and developer tools.

- SDKs in Ruby, Python, PHP, Java, Node, Go, .NET, HTML, JavaScript, React, iOS, Android, and React Native.

- 24/7 customer support.

- Advanced fraud detection and protection tools.

- PCI-SSS Level 1 compliant.

- Accepts most payment methods.

- Supports 40+ countries and 130+ currencies.

Pros and cons

| Pros | Cons |

|---|---|

| Highly customizable with powerful APIs and developer tools. | Add-on fees for billing and invoicing. |

| No monthly fees. | Account stability issues (sudden holds). |

| Wide country- and currency-support. | Flat-rate processing fees can be expensive for low-volume businesses. |

| Advanced fraud detection and security features. | Does not work with other merchant accounts. |

| 24/7 customer support. |

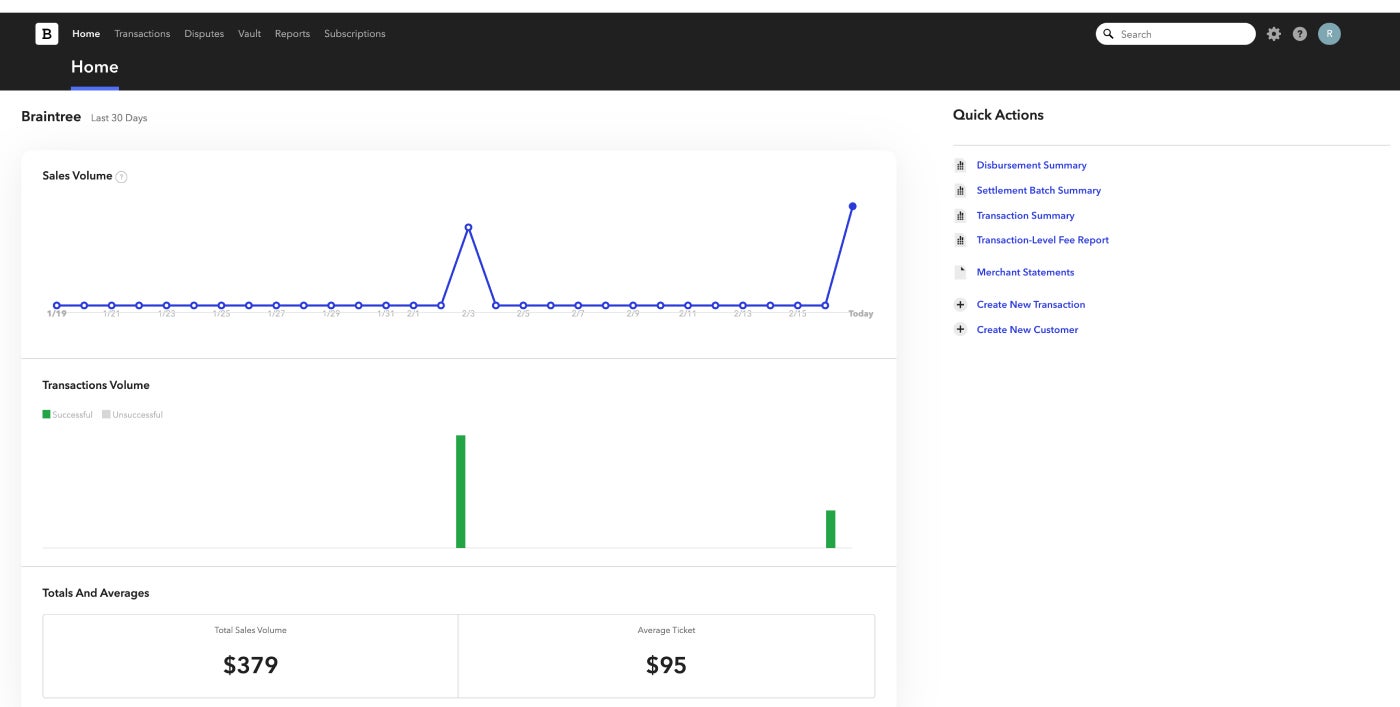

Braintree: Best for subscription and recurring billing

Our rating: 4.49 out of 5

Braintree, a PayPal company, is a payment gateway that offers flexible payment options, customizable tools, and seamless integration with major platforms. Its robust subscription and billing capabilities make it an excellent choice for businesses focused on these payment options, especially with Braintree’s support for multiple currencies and payment methods.

Why I chose Braintree

Braintree stands out for its dedicated focus on subscription and recurring billing, providing a wide range of tools designed to simplify the management of these complex payment flows. Its transparent pricing model and advanced features, such as dynamic control over billing intervals, customer management, and easy integration with digital wallets, make it ideal for subscription-based businesses.

Braintree’s fraud protection and detailed analytics give businesses the insights they need to optimize their billing processes and enhance customer experience, setting it apart from other gateways that may require more complex configurations for similar capabilities.

Pricing

- Monthly fee: $0

- Processing fees:

- Cards and digital wallets: 2.59% + 49 cents per transaction.

- Venmo: 3.49% + 49 cents per transaction.

- ACH payments: 0.75%, capped at $5 per transaction.

- Add-on fees:

- Cross-border fee: 1% per transaction.

- Currency conversion: 1% per transaction.

- Custom pricing available for high-volume businesses.

Features

- Robust subscription and billing tools.

- Accepts PayPal and Venmo.

- SDKs in Ruby, Python, PHP, Java, Node, Go, .NET, JavaScript, iOS, Android, and React Native.

- Wide variety of easy third-party integrations.

- Advanced fraud protection.

- Supports 40+ countries and 130+ currencies.

- Data portability for those switching from other gateways.

- Sandbox environment for testing.

Pros and cons

| Pros | Cons |

|---|---|

| Accepts PayPal and Venmo. | Higher standard flat-rate fees. |

| Robust subscription and billing tools. | Limited support for standard customer service. |

| White-glove support for enterprise businesses. | Account approval may be more stringent and lengthy. |

| Works with other merchant accounts. |

Adyen: Best for large enterprises

Our rating: 4.43 out of 5

Adyen is highly suitable for large enterprises that need a scalable solution with its wide range of payment methods and currencies. It is known for its robust, all-in-one platform, large international presence, advanced fraud protection, and real-time reporting. It uses an interchange plus processing fee structure where each transaction is charged the payment method fee plus a fixed add-on Adyen processing fee.

Why I chose Adyen

With its availability in 100+ countries and support for 180+ currencies, Adyen is known for its ability to handle the complex needs of large enterprises, particularly those with a global footprint. It allows merchants operating across multiple regions to offer their customers various payment methods within a single streamlined solution. Adyen’s advanced fraud protection and real-time analytics also provide enterprises with critical insights and security, enhancing overall efficiency.

Additionally, it is also the only payment gateway on this list that offers standard interchange-plus pricing–the other providers, like Stripe and Braintree, may offer interchange-plus pricing but only upon request.

Pricing

- Monthly fee: $0

- Payment processing fees: Payment method fee + 13 cents per transaction.

- May require reserves.

Features

- Global payment processing.

- SDKs in C#, Go, Java, Node, PHP, Ruby, Python, .NET, HTML, React, iOS, Android, and React Native.

- Supports 100+ countries and 180+ currencies.

- A unified platform that integrates acquiring, processing, and settlement.

- Real-time analytics and reporting.

- Scalable infrastructure.

- Advanced fraud protection tools.

- Sandbox environment for testing.

Pros and cons

| Pros | Cons |

|---|---|

| Easily scalable for large enterprises. | May require reserves. |

| Extensive global payment options. | Less suitable for small businesses. |

| Interchange-plus pricing. | Does not work with other merchant accounts. |

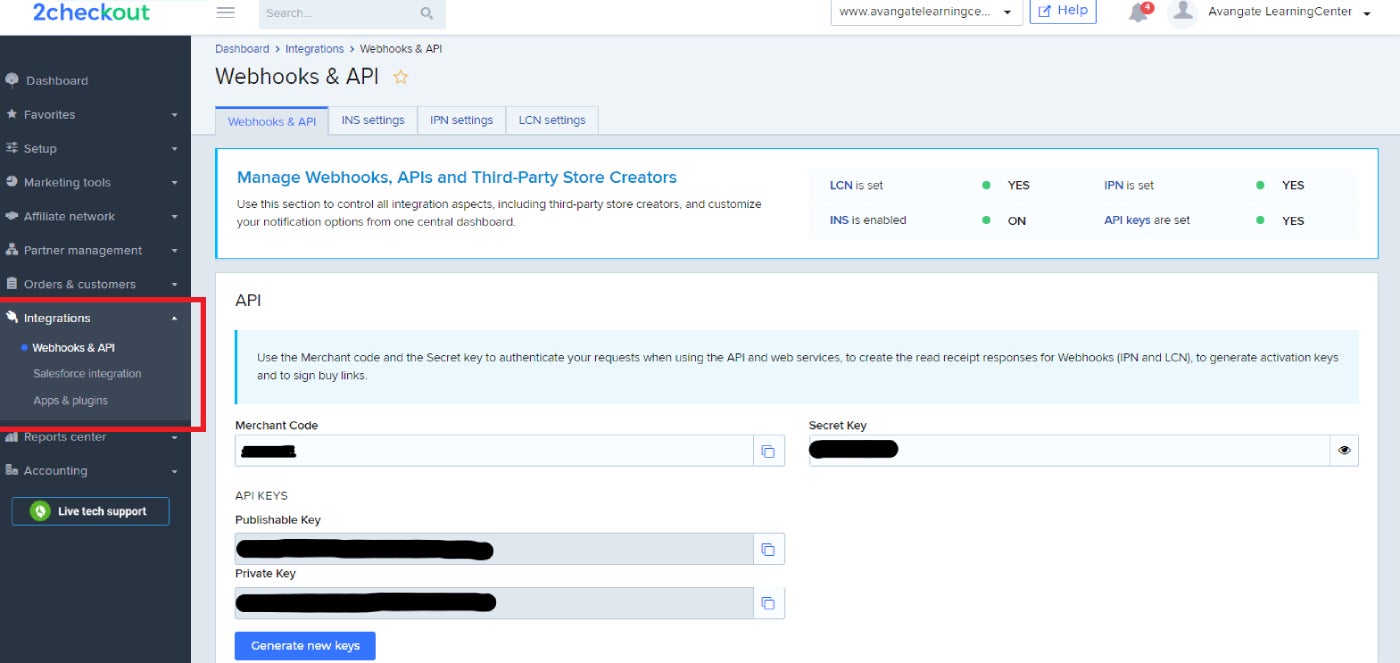

2Checkout (now Verifone): Best for international commerce

Our rating: 4.39 out of 5

2Checkout, now rebranded as Verifone, is an excellent payment gateway for businesses focused on international commerce because of its extensive global reach and support for multiple currencies and payment methods. It offers customizable checkout options, built-in tax and compliance management, robust fraud protection, and merchant of record services.

Why I chose 2Checkout

2Checkout stands out for its ability to support global businesses with localized payment options. It supports 230+ countries, 30+ languages, and 100+ currencies — more than any other payment gateways on this list — and has built-in tax and compliance management tools that simplify cross-border transactions.

Unlike other gateways, 2Checkout also acts as the merchant of record, which means it takes on the liabilities to the customers, handles compliance, and handles taxes, refunds, and chargebacks. This, along with its robust fraud protection and customizable checkout options, makes it a strong choice for businesses looking to expand internationally with minimal hassle.

Pricing

- Monthly fee: $0

- Processing fees:

- 2Sell Plan: 3.5% + 35 cents per transaction.

- 2Subscribe Plan: 4.5% + 45 cents per transaction.

- 2Monetize Plan: Tailored pricing.

Features

- Supports 230+ countries, 30+ languages, and 100+ currencies.

- Merchant of record services.

- Advanced fraud protection.

- Integrated tax management.

- Detailed reporting and analytics.

Pros and cons

| Pros | Cons |

|---|---|

| Extensive global reach and support. | High transaction fees. |

| Merchant of record services. | Account holds without prior notice. |

| Localized checkout experience. | Subscription management has add-on fees in the lowest plan. |

| Does not work with other merchant accounts. |

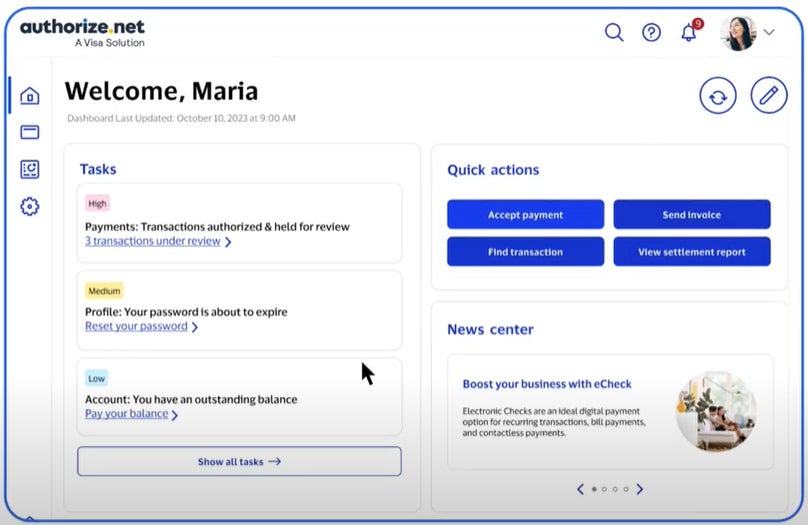

Authorize.net: Best for extensive fraud protection

Our rating: 4.36 out of 5

Authorize.net is one of the most popular payment gateways that is ideal for businesses that prioritize extensive security and fraud prevention. It has a user-friendly interface, a wide range of integrations, and multiple payment options. This is the only payment gateway on this list that allows merchants to use their existing merchant account, if they already have one.

Why I chose Authorize.net

Its exceptional focus on security makes Authorize.net a top pick for merchants looking for a highly reputable, reliable, and secure platform. Its Advanced Fraud Detection Suite provides over a dozen customizable fraud filters, which help protect from suspicious transactions. Additionally, Authorize.net’s flexibility in allowing businesses to use their existing merchant accounts makes it a suitable choice for high-risk merchants or other merchants with unique business models.

Pricing

- Monthly fee: $25.

- Processing fee:

- All-in-one plan: 2.9% + 30 cents per transaction.

- Payment gateway+eCheck plan:

- Credit card transactions: 10 cents per transaction + 10 cents daily batch fee.

- eCheck: 0.75%.

- Payment gateway plan: 10 cents per transaction + 10 cents daily batch fee.

Features

- Comprehensive fraud protection.

- Customer information manager.

- Invoicing and recurring payments.

- Allows use of your own merchant account.

- Detailed reporting tools.

- 24/7 customer support.

Pros and cons

| Pros | Cons |

|---|---|

| Works with existing merchant accounts. | Monthly fees make it expensive for small businesses. |

| Robust fraud prevention tools with customizable filters. | Only available for merchants in the US and Canada. |

| 24/7 customer support. |

How do I choose the best payment gateway for my business?

Choosing the best payment gateway depends on your unique business needs, industry, and plans for growth. For tech-savvy merchants or developers looking for a payment gateway for their projects, look for payment gateways with robust API capabilities, wide SDK language availability, and comprehensive developer documentation.

If your business values customization and integration flexibility, Stripe’s powerful API and developer tools make it a top choice. For large enterprises with global reach, Adyen stands out with its extensive international support and interchange-plus pricing model. Meanwhile, 2Checkout is ideal for companies targeting international markets, thanks to its comprehensive global reach and built-in compliance management.

For businesses focused on subscriptions or recurring billing, Braintree provides robust tools that make managing complex payment models straightforward and efficient. If security is your top priority, Authorize.net offers advanced fraud prevention tools that provide peace of mind, along with the flexibility to use your existing merchant account.

Ultimately, the right payment gateway will align with your business model, industry requirements, and growth ambitions — prioritize one that offers the specific features, pricing, and support your business needs to thrive.

Methodology

I evaluated several payment gateways that offer APIs and developer tools based on several criteria: security and compliance, integration and API capabilities, payment features and global reach, performance and reliability, pricing and contract, and user experience and support. My research for this article involved in-depth analysis of product pages and documentation, review of user feedback, and creation of test accounts, if available.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

Source link