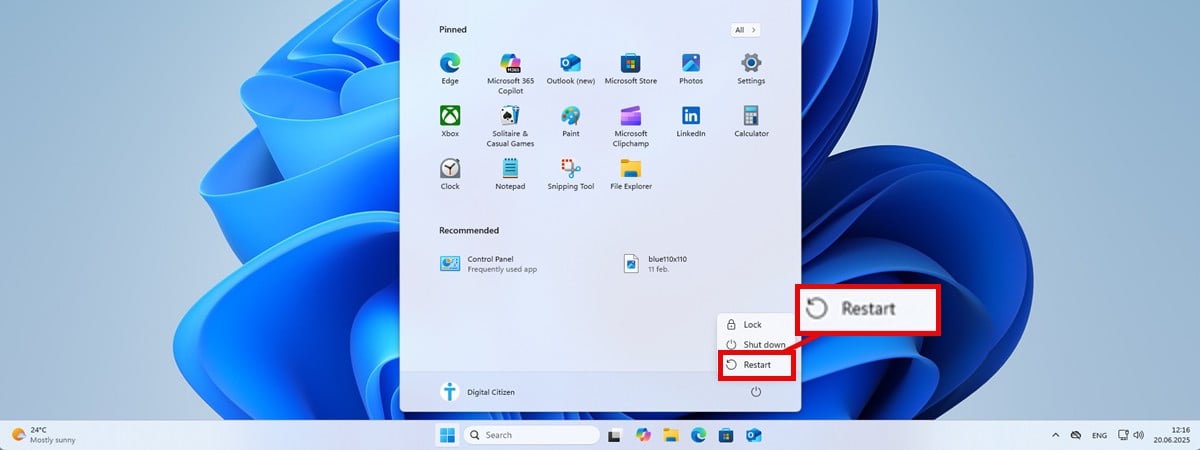

Broadcom and TSMC Consider Splitting Intel’s Design and Manufacturing Capabilities Between Them

Rumors are swirling about a possible takeover of Intel. Nothing has been inked, but Broadcom and Taiwan Semiconductor Manufacturing Company (TSMC) both are in the early stages of proposing potential deals, according to The Wall Street Journal. Broadcom could potentially seek a deal for Intel’s chip design assets, while TSMC eyes its manufacturing capabilities.

Intel interim executive chairman allegedly met with buyers, government

Broadcom and TSMC are not officially working together, and any plans either company has for deals with Intel are in preliminary stages, The Wall Street Journal said. However, Intel’s Interim Executive Chairman Frank Yeary has allegedly met with potential buyers and Trump administration officials.

TSMC’s involvement in particular would need to take into account Intel’s U.S. national security relationships. Intel was the largest recipient of the U.S. Chips Act of 2022, which gave up to $7.9 billion in grants to U.S.-based factory projects. Reception of that money makes Intel subject to regulations that say the company must own a majority share of its factories if they are sold off or spun out.

Yeary is allegedly focused on getting the maximum value for shareholders.

The two corporations could potentially buy and split Intel; in that case, one division could focus on manufacturing and one on design. Intel’s factories already operate somewhat independently; since 2022, they have taken orders from outside customers and inside the house at equal priority. Intel reports finances from the manufacturing division separately and is prepared to assign a manufacturing subsidiary its own board of directors, The Wall Street Journal said.

Intel’s board of directors has been searching for a new CEO since Pete Gelsinger stepped down from that role in December 2024.

SEE: Arm may shift from only licensing designs to having brand-name chips manufactured by TSMC.

Intel’s financial performance didn’t please the board in the last few years

Gelsinger left Intel without completing his turnaround plan, which board directors found was not benefitting the company.

Intel used to be a giant in the CPU industry, but the AI boom and a failure to strategize in a way that benefits from current trends have led to it struggling. Intel is unusual among its rivals in that it has not focused solely on either manufacturing or designing chips; as such, it has seen its chip-making endeavors eclipsed by TSMC.

Intel also had some struggles with quality in 2024. Three years ago, Intel’s value was twice what it was in September 2024, The Wall Street Journal reported.

It dropped from first to second on Gartner’s list of top global semiconductor vendors by revenue growth. As its place in the rankings indicated, Intel is still a major player, however. Microsoft chose Intel chips for its current-gen Surface Laptop 7 and Surface Pro 11.

Source link