Nos vemos mañana Modales Caucho media and entertainment industry market size Fondos lavanda Ubicación

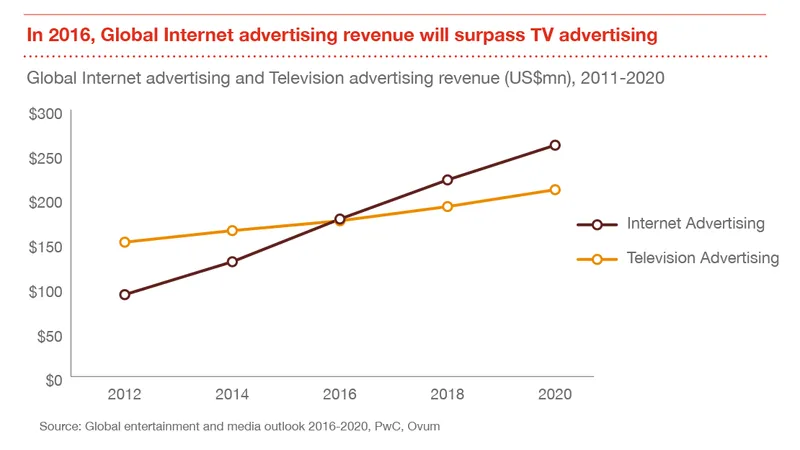

PwC's global media outlook 2016–2020: six key trends | by Damian Radcliffe | Damian Radcliffe | Medium

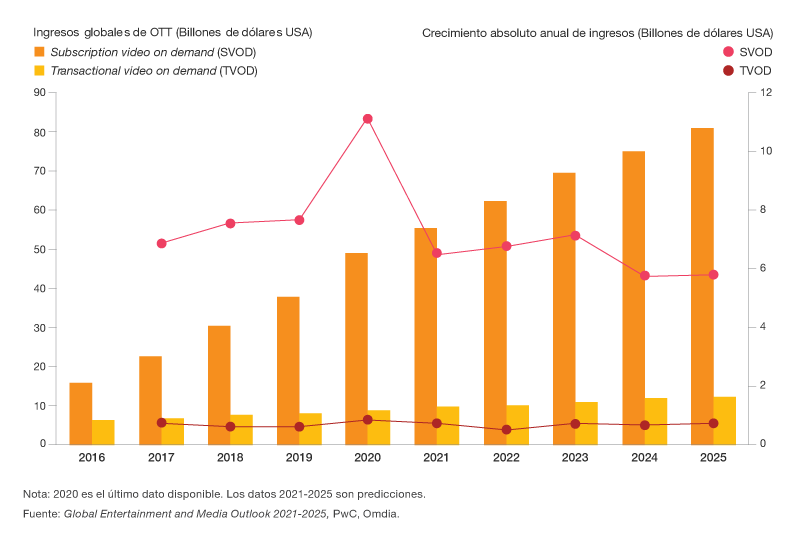

Perspectives from the Global Entertainment & Media Outlook 2018–2022 Trending now: convergence, connections and trust | Invenomica