U.S. seized $8.2 million in crypto linked to ‘Romance Baiting’ scams

The U.S. Department of Justice (DOJ) has seized over $8.2 million worth of USDT (Tether) cryptocurrency that was stolen via ‘romance baiting’ scams.

Previously referred to as ‘pig butchering,’ in this type of financial fraud victims are manipulated into making investments on fraudulent websites/apps that showcase massive returns.

Convinced they’re making a profit, the victims invest increasing amounts, but when they attempt to make any significant withdrawals, they hit various problems that prevent them from completing the action.

Ultimately, they realize they invested in a fake platform and all their money went straight into the threat actors’ pockets.

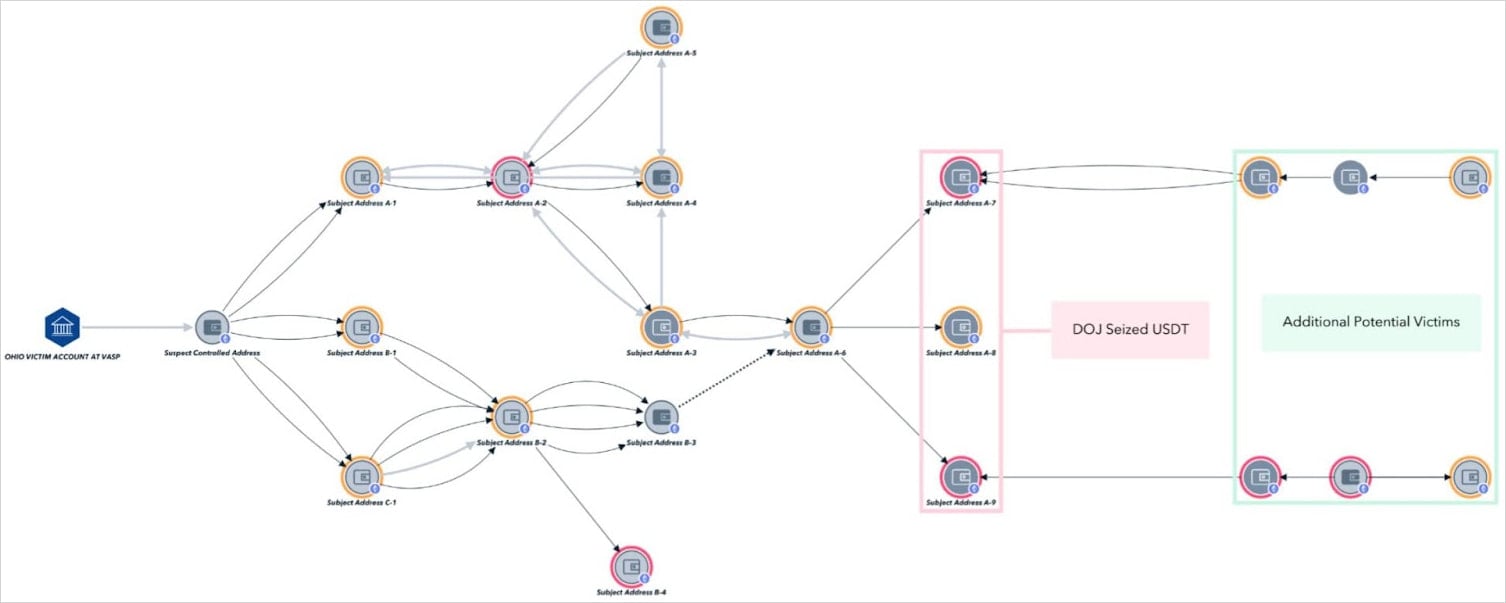

Blockchain intelligence platform TRM Labs reports that U.S. state investigators, primarily the FBI, uncovered laundering patterns of amounts linked to ‘romance baiting’ operators, enabling them to file a dual legal forfeiture:

- Wire fraud (18 U.S.C. 981(a)(1)(C)) for directly traceable funds.

- Money laundering (18 U.S.C. § 981(a)(1)(A)) for commingled or untraceable funds.

This allowed the full seizure of the assets. As explained in the complaint, Tether Limited froze the funds in June 2024, burned the original USDT tokens, and reissued them into law enforcement-controlled wallets in November 2024.

The seizure opens the pathway for restitution to known victims, as well as others whom the FBI is attempting to locate by backward tracing the seized wallets.

Source: TRM Labs

The complaint names five victims from Ohio, Michigan, California, Utah, and North Carolina, who collectively lost over $1.6 million. A total of 38 victimized cryptocurrency accounts with losses exceeding $5.2 million were confirmed.

The threat group behind the particular ‘romance baiting’ operation is believed to be tied to human trafficking syndicates in Cambodia and Myanmar.

The scam operation relied on typical tactics such as allowing initial small profit withdrawals to build trust, claiming “taxation” and “credit score” fees as pretexts for requesting more money, and then resorting to threats and intimidation once victims ran out of money.

The worst-case individual loss described in the complaint was that of a victim from Mentor, Ohio, who lost approximately $663,352 in total ($250,000 in initial investment, $174,400 in “release fees,” $238,946 in “handling fees”).

The threat actors demanded another $300,000 to “improve her credit score,” but after having already liquidated her entire Roth IRA and life savings, she couldn’t pay that amount. In response, the scammer threatened to harm her friends and family.

‘Romance baiting’ scams can be devastating for victims, so looking for red flags and taking your time to confirm investment platform legitimacy is crucial.

Never trust “guaranteed returns” investment opportunities and never invest more than you can afford to lose.

Source link