US recovers $225 million of crypto stolen in investment scams

The U.S. Department of Justice has seized more than $225 million in cryptocurrency linked to investment fraud and money laundering operations, the largest crypto seizure in the history of the U.S. Secret Service.

The state’s investigators used blockchain analysis to trace the funds stolen from over 400 victims, which were then laundered through a complex network of cryptocurrency addresses to obscure their origin.

“The complaint alleges that the cryptocurrency addresses that held the over $225.3 million in cryptocurrency were part of a sophisticated blockchain-based money laundering network that executed hundreds of thousands of transactions and was used to disperse proceeds of cryptocurrency investment fraud across many cryptocurrency addresses and accounts on the blockchain to conceal the source of the illegally obtained funds,” reads an announcement by the Department of Justice.

The action, which involved the U.S. DOJ, the FBI, the Secret Service, and private partners Tether and TRM Labs, represents the largest cryptocurrency seizure (by amount) in USSS history.

Funds were consolidated into seven final USDT wallet groups, each holding between $3M and $135M, triggering significant amounts of unnecessary gas fees (up to $125,000) to disrupt traceability.

TRM found 144 OKX accounts used in the scheme, many tied to Vietnamese ‘know your customer’ documents where the photos were taken in the same location, strongly suggesting organized fraud ring operations.

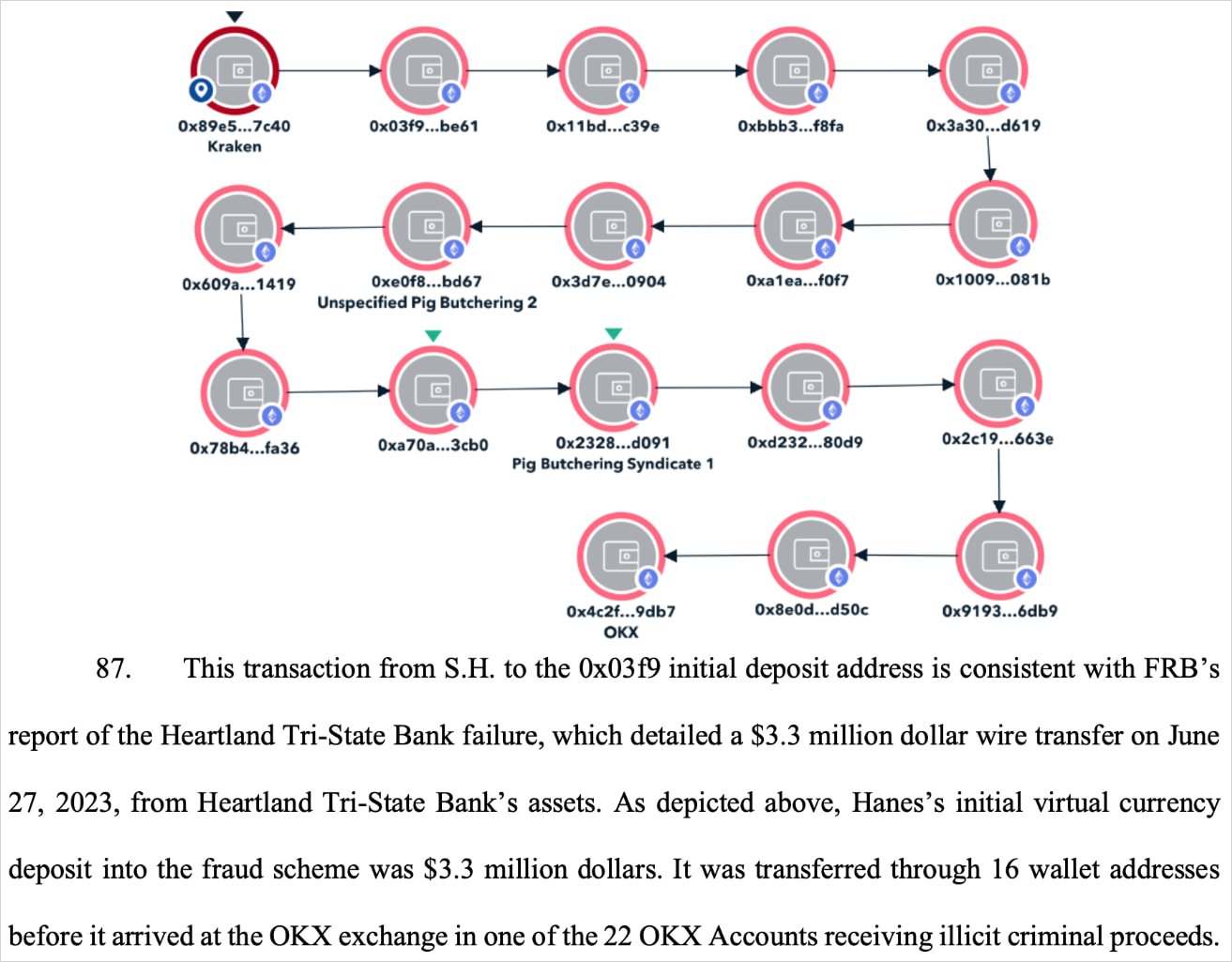

In one of the seven cases highlighted in the legal complaint, there’s the example of an OKX account receiving 3.1 million USDT from a Heartland Tri-State Bank CEO (“S.H.”).

This was just one of the payments that person made to the scammers. In total, S.H. was tricked into wiring $47.1M from his own bank’s assets, believing he was making legitimate crypto investments.

Source: TRM Labs

Despite the complex obfuscation, the blockchain investigators could still map the laundering network by using LIFO (Last-In-First-Out) tracing to follow funds through 93 scam deposit addresses, then 35 intermediary wallets, and finally consolidated into seven groups.

Stablecoin Tether (USDT) froze the tokens linked to these groups, burned them, and reissued the equivalent amount to the U.S. government, enabling civil forfeiture recovery.

This important mechanism may only be used when legal groups for forfeiture exist.

To activate it, the U.S. DoJ invoked two federal statutes, namely 18 U.S.C. § 981(a)(1)(A) and 18 U.S.C. § 981(a)(1)(C), which allow forfeiture of property involved in money laundering and derived from wire fraud, respectively.

The next step in the process should be to identify victims through a claims process and use the seized amounts for restitution, although no specific announcements were made about this phase.

Source link