The best recurring billing software can help with automating invoices, processing payments securely, and tracking subscriptions while ensuring compliance with tax regulations. Those enable you to maintain steady cash flow and improve customer retention. Here’s my list of the best recurring billing software designed to streamline payments and automate billing processes.

- Best overall software for integrated, scalable recurring billing features: QuickBooks Online

- Best for subscription-based businesses: Helcim

- Best for enterprises needing advanced recurring billing automation: Invoicera

- Best for instant access to your cash: Square

- Best free accounting solution with essential recurring billing support: Wave

- Best for medium to large businesses: Stax Bill

Top recurring billing software comparison

| QuickBooks Online | ||||

| Helcim | ||||

| Invoicera | ||||

| Square | ||||

| Wave | ||||

| Stax Bill |

QuickBooks Online: Best overall software for integrated, scalable recurring billing features

I like that QuickBooks Online combines accounting and automated recurring billing. It allows you to schedule recurring invoices, automate payments, and apply location-based sales tax for compliance across multiple jurisdictions. Seamless integration with payment processors and accounting tools ensures accurate financial tracking and reconciliation.

With its scalability and automation, QuickBooks Online simplifies billing for your growing business. However, while it is excellent for managing recurring invoices, it doesn’t offer a true subscription management system like Helcim. If you have a business with a complex recurring revenue model — especially if you need automated trial conversions, prorated billing, and flexible subscription tiers — you may find QuickBooks lacking.

Pricing

QuickBooks Payments:

- Bank payments: 1%

- Visa, Mastercard, Discover, Amex plus digital wallets:

- Online payments: 2.99%

- Card reader: 2.5%

- Keyed-in cards: 3.5%

Users must have a subscription to QuickBooks Online to use QuickBooks Payments and recurring billing.

QuickBooks Online (all plans include recurring invoices):

- Simple Start: $30 per month for one user

- Essentials: $60 per month for three users

- Plus: $90 per month for five users

- Advanced: $200 per month for 25 users

New QuickBooks Online users can choose between 50% off for three months or a 30-day free trial.

Standout features

- Automated inventory management: Tracks stock across multiple e-commerce platforms and calculates COGS in real-time.

- Seamless payment integration: Integrates with QuickBooks Payments to activate and manage transactions effortlessly.

- Bank reconciliation: Matches received payments with actual bank deposits for accurate financial tracking, a feature often missing in lower-cost software.

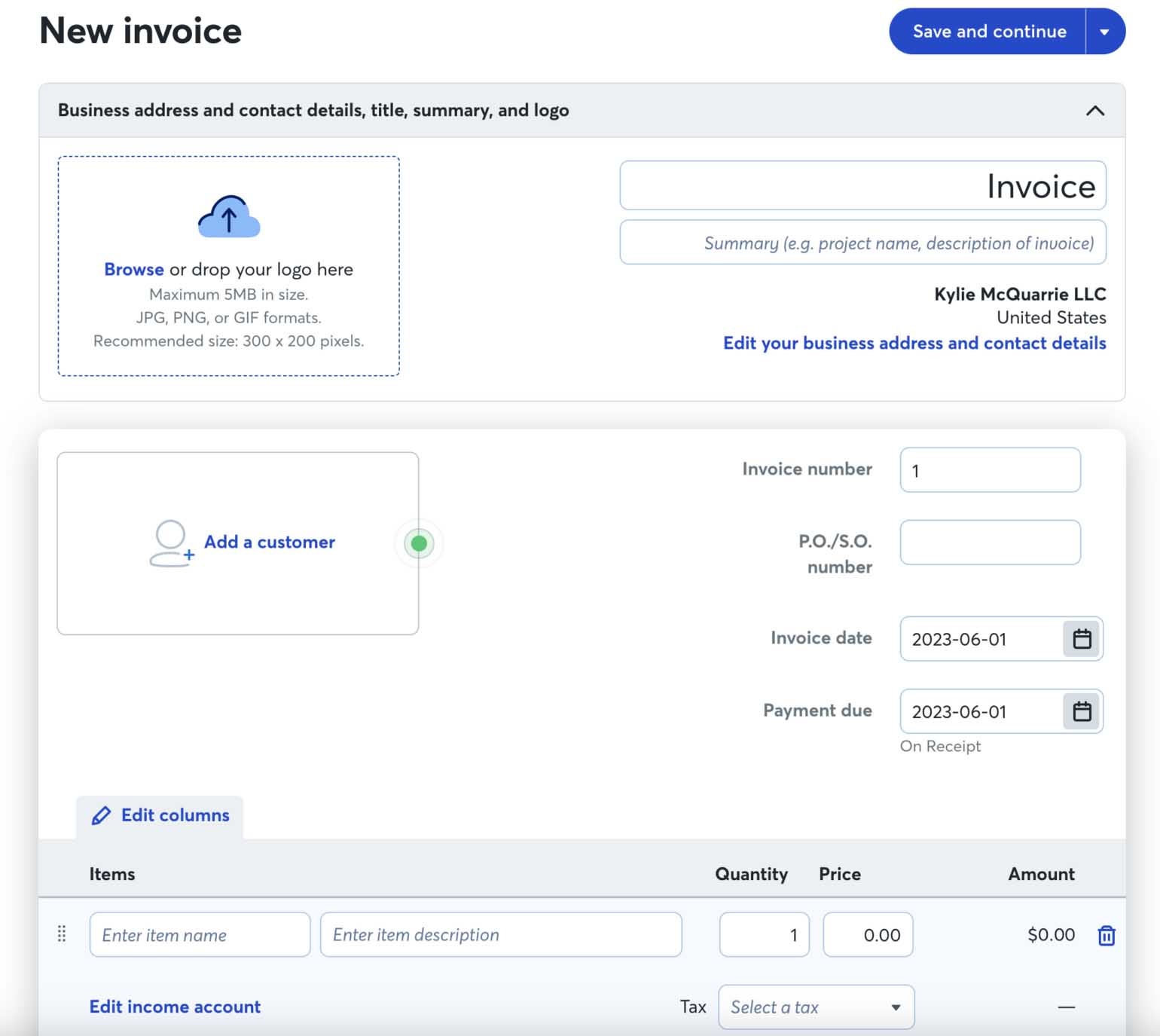

- Smart invoicing automation: Automatically adds unbilled charges to invoices, supports customizable recurring invoice templates, and sends overdue payment reminders individually or in batches.

- Real-time invoice preview: Displays a live PDF version of invoices as details are entered, improving accuracy and customization.

- Advanced sales tax management: Automatically calculates and applies sales tax based on transaction location, ensuring compliance across multiple jurisdictions.

- Class and location tracking: Enables financial tracking by segment, division, or geographic location (available in QuickBooks Online Plus and Advanced).

Pros & cons

| Pros | Cons |

|---|---|

|

|

Helcim: Best for subscription-based businesses

I recommend Helcim’s Subscription Manager for businesses relying on recurring revenue, like gyms and online publications. It lets you create unlimited subscription plans with flexible pricing and billing schedules, which is great for scaling. Your customers can then sign up manually or via self-enrollment links, making the onboarding process smooth. I also like how Helcim automates free trials and prorated billing, eliminating the need for manual adjustments.

What holds it back is its lack of real-time, two-way accounting integration. It offers a sync tool for QuickBooks Online, but it doesn’t provide automatic data updates, which feels like a gap. The Xero integration is even more limited, only transferring payments from Helcim invoices. That means you still have to manually enter most of your Helcim transactions into your accounting system, which adds unnecessary work.

Pricing

- Bank payments: 0.5% plus 25 cents with a maximum of $6

- Credit card payments:

- Online and manually keyed payments: 2.43% to 3.18% plus 25 cents

- In-person payments: 1.79% to 2.68% plus 8 cents

Standout features

- Helcim Fee Saver: Lets businesses offset credit card processing costs by applying a convenience fee to customer transactions, reducing or eliminating processing expenses.

- Subscription management: Supports multiple subscription plans with automated free trial management, prorated billing and flexible customer onboarding through manual entry or self-enrollment links.

- Mobile point-of-sale solutions: Provides portable POS hardware, including a smart terminal and card reader, for secure, on-the-go payment processing.

- Transparent interchange-plus pricing: Offers clear, interchange-plus pricing with automatic volume discounts, ensuring cost-effective transaction rates as businesses scale.

- Comprehensive payment tools: Includes invoicing, a virtual terminal and a mobile app, supporting multiple payment methods for streamlined business operations.

Pros & cons

| Pros | Cons |

|---|---|

|

|

Invoicera: Best for enterprises needing advanced recurring billing automation

I chose Invoicera as the best option for enterprises requiring a highly automated and scalable recurring billing system with deep customization and workflow integration. It supports unlimited invoices, automated late payment reminders, scheduled billing, and a client portal — essential if your business handles large transaction volumes.

Its Create Recurring menu makes invoice automation seamless, reducing manual work for your finance teams and IT departments. With API support and integrations for ERP and CRM systems, Invoicera streamlines recurring revenue management while ensuring smooth cross-platform connectivity.

Pricing

- Starter: $19 per month for one user

- Business: $49 per month for up to 10 users

- Enterprise: $99 per month for up to 20 users

- Infinite: $149 per month for unlimited users

Standout features

- Global invoicing capabilities: Supports over 120 currencies and 16 languages, enabling enterprises to manage international billing and maintain compliance across multiple regions.

- Advanced client portal: Provides businesses with a centralized platform where clients can pay invoices, dispute charges, and approve or reject estimates, improving transparency and payment efficiency.

- Automated estimate management: Streamlines the sales process with features that allow businesses to duplicate estimates, convert them into invoices, and schedule estimates for future billing cycles.

- Enterprise-grade project billing: Integrates invoicing with project management by assigning billable and nonbillable time, attaching essential documents, and tracking expenses for specific projects or clients.

- Scalable automation for high-volume billing: Is designed for enterprises with complex recurring revenue models, offering deep workflow automation, API integrations, and multiuser access to streamline financial operations.

Pros & cons

| Pros | Cons |

|---|---|

|

|

Square: Best for instant access to your cash

Square transformed the way businesses accept payments by eliminating reliance on cash and peer-to-peer apps, as well as the complexities of traditional merchant services. I like that it doesn’t require an application or approval process, making it easier for you to start accepting payments without long-term contracts and monthly fees. Every free Square account includes payments, POS software, and online ordering, giving your business an all-in-one solution for managing transactions.

With Square Business Checking, you can access funds from credit card sales instantly, improving cash flow without waiting for standard bank transfers. For tech professionals, Square’s ecosystem offers seamless integration with e-commerce platforms, robust API support for custom payment solutions, and PCI-compliant security features to protect transactions.

Pricing

- Bank payments (ACH transfers): 1% per transaction, with a minimum fee of $1

- Credit card and mobile wallet payments:

- Online transactions: 2.9% + 30 cents per transaction

- In-person transactions (using a card reader): 2.6% + 10 cents per transaction

- Manually keyed-in transactions: 3.5% + 15 cents per transaction

- Card on file (recurring payments): 3.5% + 15 cents per transaction

Standout features

- Instant access to funds: Provides real-time access to credit card sales revenue without transfer delays via Square Business Checking, eliminating the need to wait for bank processing times.

- Automated recurring invoicing: Lets you schedule and manage recurring invoices seamlessly through Square Invoices or directly within the Square POS app, streamlining billing operations.

- Scalable POS hardware solutions: Offers a range of hardware options, from mobile card readers to fully integrated POS terminals, allowing brick-and-mortar businesses to customize in-store payment setup based on operational needs.

- Robust API and developer tools: Provides an extensive suite of APIs for payment processing, inventory management, and customer data, enabling businesses to build custom integrations and automate workflows.

- Advanced security and compliance: Includes PCI-compliant encryption, fraud detection tools, and chargeback management features to protect transactions and maintain regulatory compliance.

Pros & cons

| Pros | Cons |

|---|---|

|

|

Wave: Best free accounting solution with essential recurring billing support

I recommend Wave if you’re seeking a free accounting solution because it offers a full suite of financial tools without hidden costs, making it ideal if you need both accounting and invoicing in one platform. It supports recurring billing, customizable invoices, and automated sales tax tracking, which is crucial if your business operates across multiple jurisdictions.

For tech professionals and business owners, its seamless integration with Wave Payments simplifies online transactions, ensuring smooth cash flow without the need for third-party payment processors. With built-in expense tracking, bank reconciliation, and financial reporting, Wave provides a cost-effective way to manage business finances while maintaining visibility over revenue streams.

Pricing

- Starter: Free for one user

- Pro: $16 per month for unlimited users

Standout features

- Scalable financial tools for tech-driven businesses: Provides unlimited invoicing, income and expense tracking, and essential accounting features at no cost, making it ideal for tech startups and solopreneurs needing a streamlined financial system without added overhead.

- Seamless bank and payment integrations: Connects an unlimited number of bank accounts and syncs transactions in real time, reducing manual data entry and improving cash flow visibility.

- Advanced financial reporting for data-driven decision-making: Offers standard reports like General Ledger, Profit and Loss statements, A/R and A/P aging, and trial balances, giving business owners, CFOs, and finance teams real-time financial insights.

Pros & cons

| Pros | Cons |

|---|---|

|

|

Stax Bill: Best for medium to large businesses

I chose Stax Bill as the best option for medium to large businesses because it offers deep API integrations, advanced automation, and enterprise-level analytics that smaller businesses typically don’t need. Its ability to streamline complex billing workflows makes it ideal if your company has high transaction volumes and subscription models at scale.

For tech professionals, Stax Bill’s customization options, real-time analytics, and automation capabilities make it a powerful tool for optimizing financial operations. However, these advanced features come at a cost, with an annual fee and a significant investment in setup and integration, making it a good fit only if your business can fully leverage its capabilities.

Pricing

- Growth: $499 per month for businesses with up to $85,000 in monthly billings

- Enterprise: Custom quote

Standout features

- Self-service subscription management: Allows subscribers to self-register, update billing details, and manage their subscriptions without manual intervention, reducing administrative workload for large businesses.

- Automated dunning and collections: Provides configurable dunning management, including automated emails and customizable collection workflows, helping businesses recover revenue from late-paying customers efficiently.

- Sales tax automation with Avalara integration: Seamlessly integrates with Avalara to handle sales tax calculations, reporting, and remittances across multiple jurisdictions, ensuring compliance for businesses with a nationwide or global subscriber base.

Pros & cons

| Pros | Cons |

|---|---|

|

|

Review methodology

I conducted in-depth research on each provider in this guide, securing trial subscriptions whenever possible. I also reached out to customer service representatives to gather details unavailable on the provider’s website. My primary focus was on pricing, subscription management features, and how well the software integrated with different bookkeeping systems and API features.

How do I choose the best recurring billing software for my business?

The best recurring billing software for your business depends on your current bookkeeping software, costs, and whether you have only a few customers needing recurring bills or your entire business runs on a subscription model.

✅ Prioritize bookkeeping integration.

Regardless of the recurring billing software that you select, eventually, the income and cash flow need to make their way into your financial statements. The easiest way to make this happen is by choosing bookkeeping software that can send recurring invoices.

If you choose a payment processor or specialized billing software, ensure that it has a quality bookkeeping integration or, at the very least, that you have a plan for how you’re going to get the information into your bookkeeping system at least monthly.

✅ Evaluate both fixed and transaction costs.

You need to consider both the flat monthly fee and the cost of processing the credit card or bank transfer:

- Monthly cost: There are plenty of free (such as payment processing companies) and no-additional-cost options (such as bookkeeping software you’re already paying for). However, if you want additional features, it might make sense to pay a monthly fee for specialized billing software.

- Transaction processing: No matter which solution you choose for recurring billing, you’ll need to pay a fee to process the credit card or bank transfer transactions. If you use free software provided by a transaction processor, compare the cost of their transaction processing with other options. Many accounting or billing software options will allow you to select from multiple payment gateways, giving you a little more control over your transaction processing cost.

✅ Choose scalable solutions for high subscription volumes.

If your entire business revolves around customer subscription plans, then you need a recurring billing solution that can manage many subscription plans easily and let you add and remove customers to and from each subscription plan. Many subscription managers even offer secure portals where your customers can manage their own subscriptions.

✅ Ensure invoice customization meets your needs.

If you need to send invoices in addition to processing monthly charges automatically, then consider the look and customization options of the invoices produced by each option. Generally, specialized billing software will give you more customization options than free software from payment processors.

✅ Prioritize API integration for seamless automation.

I consider API integration essential when selecting recurring billing software because it ensures seamless connectivity with accounting platforms, CRMs, and other enterprise tools. A well-designed API lets you automate billing workflows, sync data in real-time, and customize payment processing without disrupting existing systems.

It also gives your business the flexibility to scale, adapting to complex pricing models, customer segments, and compliance needs. Without strong API support, you’d be stuck with manual workarounds and inefficient processes that slow down operations.

Frequently asked questions (FAQs)

What is recurring billing software?

Recurring billing software automates the process of charging customers on a regular schedule, which streamlines payment collection and reduces manual tasks. It integrates with payment gateways to securely process transactions while handling invoicing, subscription management, and sales tax compliance. A modern solution often includes API access for automating workflows, customizing billing logic, and integrating with CRMs, accounting platforms, and other enterprise tools.

What is the best way to set up recurring payments?

The best way to set up recurring payments is to choose billing software with automation and customization. Use API integrations to automate payment processing and invoicing, ensuring seamless data flow between systems. Configure billing cycles, payment methods, and customer notifications based on your business model. For businesses with complex billing, choose software with a flexible pricing structure, such as tiered or usage-based billing, and PCI-compliant security measures.

What are the disadvantages of recurring billing?

Recurring billing can lead to payment failures due to expired cards, insufficient funds, or declined transactions. Without proper dunning management, businesses risk revenue loss and increased churn. Additionally, subscription-based models may face customer disputes if cancellations or refunds are not handled efficiently. For businesses using multiple platforms, ensuring seamless integration between billing, accounting, and customer management systems can be challenging without advanced API capabilities.

What’s the difference between subscription and recurring billing?

Recurring billing refers to automatically charging customers on a regular schedule, typically for fixed amounts, such as monthly service fees. Subscription billing is a subset of recurring billing, specifically designed for subscription-based businesses with features like tiered pricing, free trials, and customer self-service portals. For tech-driven businesses, subscription billing platforms often provide advanced analytics, usage-based pricing, and API integrations to support scalable, flexible revenue models.

Source link