While blockchain and cryptocurrency have created many opportunities for the average person, they have also attracted scammers, making the space rife with fraud. Whether you’re already involved or considering entering this space, here are some common crypto scams you should watch out for.

8

Wallet Draining Scams

Wallet drain scams are a serious threat that can wipe out your funds in seconds. Scammers may trick you into revealing your private keys or seed phrases, connect your wallet to a malicious website, or grant them access to your assets in other ways, which allows them to transfer and drain your crypto assets.

To protect yourself, never share your private keys or seed phrases with anyone. Always verify that you’re on an official, trusted website—especially when using decentralized exchanges—and consider using a hardware wallet for added security. Additionally, ensure that you only install legitimate wallet apps or extensions and don’t fall for fake ones.

7

Crypto Mining Schemes

Crypto mining scams come in different forms, but some are more common than others. Scammers may showcase images of high-end mining rigs and promise to double your crypto investment in just a few days, only to disappear with your funds. Others might attempt to sell you overpriced mining rigs worth only a few hundred dollars.

Likewise, they may trick you into downloading a so-called mining app that secretly hijacks your device’s processing power—also known as cryptojacking. To protect yourself, avoid any offer that guarantees unrealistically high returns, steer clear of mining apps as they’re rarely worth it, and always verify the credibility of hardware sellers before making a purchase.

6

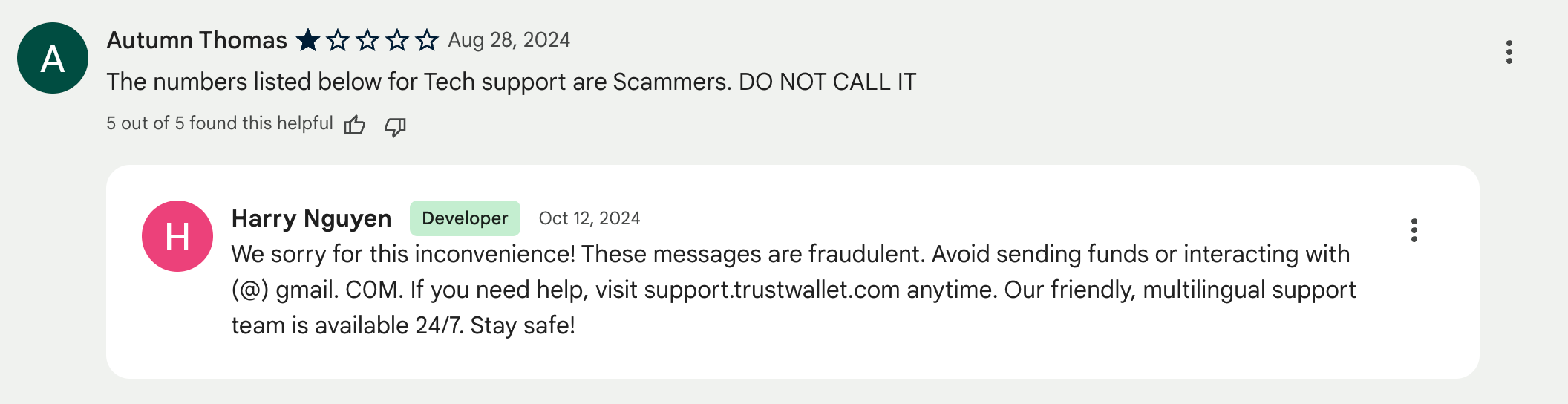

Customer Support Impersonation Scams

Scammers impersonate customer support representatives for wallets or exchanges and claim to assist with account issues, frozen funds, or lost passwords. They aim to deceive users into revealing private keys, seed phrases, or login credentials. They often target users on social media and in review sections of wallet apps, where people post complaints.

To protect yourself from such scams, always contact support through official channels, avoid clicking links from suspicious accounts, and never share sensitive details like private keys or seed phrases—legitimate support teams will never ask for them. Also, rely only on contact information provided on the official website.

5

Rug Pull Frauds

A rug pull occurs when developers launch a new cryptocurrency project without locking or burning its liquidity, allowing them to withdraw all funds at any time. They typically make bold promises about revolutionary technology they’re working on to attract investors. Once enough money is pooled, they drain the liquidity, leaving investors with worthless tokens.

To protect yourself from such scams, you must always verify that a token’s liquidity is locked using blockchain explorers like Etherscan or BscScan or tools like DexScreener and RugCheck. Be cautious of newly launched projects with low market caps, thoroughly research the development team, and read independent reviews before investing.

4

Dusting Attack Tactics

A dusting attack occurs when hackers send tiny amounts of cryptocurrency, known as “dust,” to a wallet address. If the recipient moves the funds, believing it to be an airdrop or accidental transfer, attackers can track their transactions and attempt to de-anonymize them. Once identified, scammers may use phishing, extortion, or other tactics to target the victim.

While this attack doesn’t directly steal your crypto funds, it poses a significant privacy threat. If you receive an unexpected small crypto deposit, avoid transferring it to a centralized exchange or your wallet holding large amounts. If possible, use a crypto wallet with built-in protections against dusting attacks to maintain your anonymity.

3

Pump-and-Dump Manipulation

A pump-and-dump scheme occurs when shady influencers and self-proclaimed “gurus” collaborate to hype up a low-value cryptocurrency, mainly meme coins, that they purchase at a lower price. Using misleading promotions on social media, they artificially drive up demand, causing the price to skyrocket. Once it reaches a peak, they sell off their holdings.

The aggressive selling triggers a market crash, and unsuspecting buyers who invest at the peak, hoping for huge gains, lose their money. If a token with no solid fundamentals is being aggressively promoted, its price surges within hours and its trading volume is too low compared to its inflated market cap, it’s likely a pump-and-dump scam you should avoid.

2

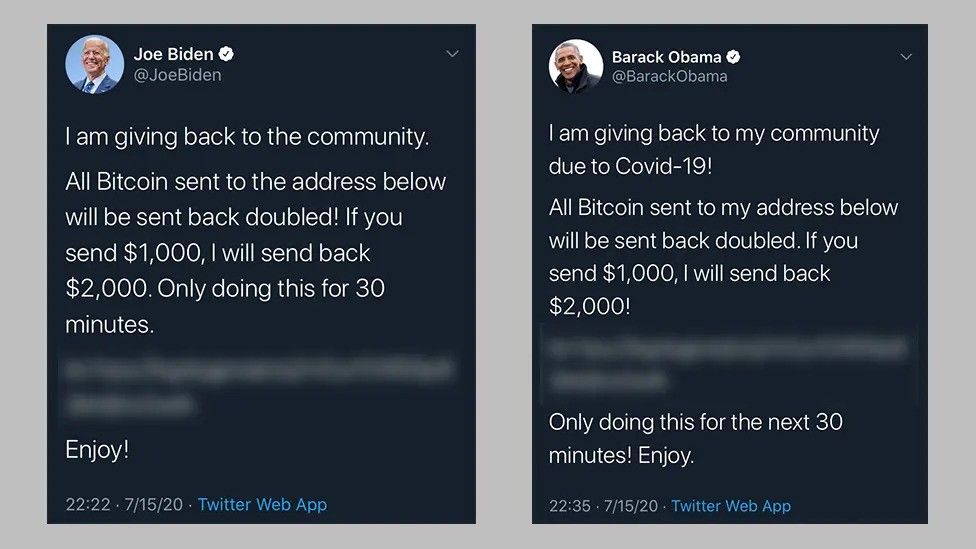

Hacked Accounts Luring Victims

Scammers hack the social media accounts of influencers or well-known figures—especially on platforms like YouTube and Twitter—and use their credibility to deceive victims. They may promise to double your crypto if you send funds to their wallet, promote a shady token they intend to dump, or offer fake airdrops that require connecting your wallet to malicious sites.

Since these scams appear to come from trusted accounts, many people fall for them and lose their money. If an account suddenly starts promoting a crypto deal, verify through other official pages of the same person or company for any warnings about a hack. Also, remember that legitimate airdrops never require you to send money.

1

Pig Butchering Investment Scam

Pig Butchering is a romance scam where scammers lure victims through social media or dating apps. They build a friendly relationship to gain trust, and once the victim is emotionally invested, they introduce a crypto investment opportunity—usually through an app or platform they control.

To make the scam seem legitimate, they may initially allow small withdrawals to build credibility. However, once the victim invests a large sum, hoping for significant returns, withdrawals are blocked, and the scammer vanishes with the funds. If someone you just met online pushes you toward crypto investments, it’s likely a scam.

Before investing, always verify that any investment platform is legitimate and regulated, and never trust promises of guaranteed returns.

The crypto space is a hotspot for scammers, so you must stay vigilant to protect your funds. Hopefully, you’re familiar with the red flags of the most common crypto scams and can avoid falling victim to them. Before making any financial decisions, constantly research thoroughly, and if something sounds too good to be true, trust your instincts and steer clear.

While we’ve highlighted some of the most common crypto scams, fraudsters constantly develop new tactics. Stay alert, be cautious, and always look for unforeseen threats.

Source link